New research has revealed the areas in Liverpool and the Wirral which are falling into debt due to the cost of living crisis.

The study from Lowell, one of Europe’s largest credit management service providers created the Financial Vulnerability Index to capture a household’s ability to manage daily finances and resist economic shocks.

Financial vulnerability is a status of financial instability or a situation leading to the exposure of financial risk and shock.

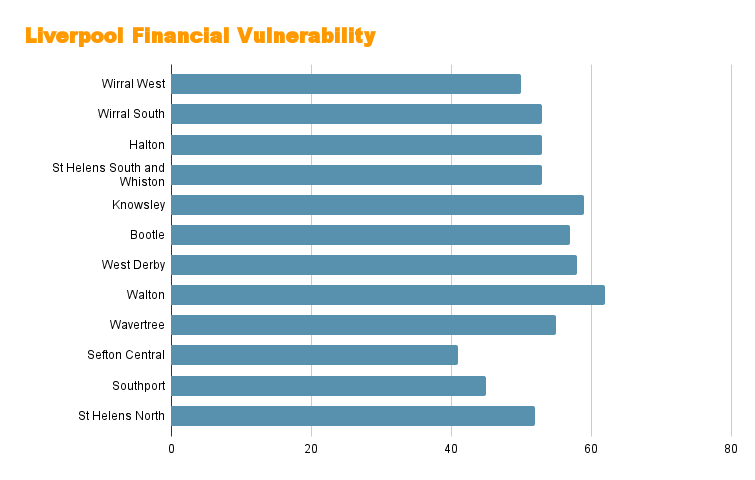

Walton, Liverpool, has been ranked as having the highest Financial Vulnerability Index score at 62, closely being followed by Knowsley with a score of 59.

John Pears, UK CEO at Lowell, said: “What this new data shows us is a complex picture of financial health in the UK.

“Overall it might be getting better, but we’re still miles away from where we were before the pandemic. Dive a little deeper and we can see a range of issues bubbling under the surface.”

He said topics such as teaching better money management, helping people better understand financial products and destigmatising debt all need to be higher on the agenda in order to improve the situation.

“The decline in overall financial vulnerability is important, but it’s still high. Default rates are rising. We need to think about what we’re doing, at an industry and government level, to improve the country’s financial health over the long term.

The index, which is measured using Lowell’s research and operational data, the UK Financial Lives Survey, and data from the UK’s Department of Work and Pensions and the Office for National Statistics, shows that the North West has the second highest FVI score of 49.1 out of 100.

The data also found 19 out of 75 constituencies in the region to have a high unemployment rate along with 27 out of 75 constituencies in the region having a high proportion of adults with bad health.

Liverpool Citizens Advice sees rise in debt support cases

Although UK households’ financial health has been improving since the beginning of the COVID-19 pandemic, increases in the cost of living appear to be preventing a quicker return to pre-pandemic levels of financial health.

The cost of some everyday food and drink products have doubled in a year and today, inflation unexpectedly jumped to 10.4%.

As a result of these factors and additional costs of rising fuel and energy bills, people across Merseyside and Knowsley are relying on loans as solution to escape financial vulnerabilities.

In 2022 @CitizensAdvice helped record numbers of people who couldn’t afford to buy food or turn their heating and power on.

2023 has been even worse so far and we predict it will be the year of the debt crisis 🧵

Watch our new video for more data insights⤵️ pic.twitter.com/xJCQCTKXi6

— Jonny Tatam-Hall (@JonnyTatamHall) March 21, 2023

Citizens Advice have called 2023 the ‘year of the debt crisis’ as the number of people being helped each month with debt issues has more than doubled since the start of the pandemic.

The Head of Operational Development at Liverpool Citizens Advice, Mick Blakeley, said: “We have seen a big increase of people coming to see us with debt, this has been caused by fuel and food price rises.

“Since April 2022 with energy prices increasing, that has put a lot of people who were maybe getting by into a situation where they are now struggling.

“It always concerns me because people are struggling, we have seen real poverty now that has not been seen since the Victorian ages so it’s a cause for concern.”

Anyone in Liverpool who is facing debt worries or struggles can reach Liverpool Citizens Advice on 0151 522 1400.

Or alternatively you can visit Community Money Advice to find your nearest debt advice centre.

“More foodbanks now than in the war”: Worst cost of living crisis since 1950s